The US shifted from analog to digital IT, and a new era of computer technology began. The PC-compatible computer was popularized by IBM, which led the way in global information sharing and industrial digitization. IBM pioneered the process with its ubiquitous, generalized hardware and software, which allowed all industries to use the same computer, which ultimately led to cost efficiency models and specialization. And is a prime example of horizontal integration at work.

The history of the process is replete with examples of giant corporations and how they work. In particular how they incorporated in the name of a single company. John D. Rockefeller used it to build his Standard Oil empire and set the terms of his business. While technically legal, Rockefeller used his holding company to monopolize one industry, allowing him to prevent other companies from expanding.

Another example of can be found in the Coca-Cola acquisition of del Valle in 2007, the main Mexican juice company. Both companies combined their efforts and merged their operations into one.

Real-life Examples

In recent years, we have seen a few real-life examples of horizontal integration. One example is the merger between Volkswagen and Porsche, which is estimated to have saved both companies $2 billion dollars. The two companies were expected to merge in 2011, but legal proceedings delayed the process until the following year. Eventually, the merger took place, with Volkswagen paying $5.6 billion for the remaining 50.1 percent of Porsche.

While the merger is not perfect, it has demonstrated the value and helped both companies achieve greater success in their respective industries. The method is often implemented to increase company size and access new markets. It may also result in a monopoly situation, as the combined firm would have greater purchasing power over its suppliers.

Other examples include mergers and acquisitions, hostile takeovers, and the acquisition of rival firms. In this case, one company may attempt to acquire another to increase its processing volume, capacity, or even market share.

However, a merger between two rival companies may result in unexpected inefficiencies, including inefficiencies and differences in management styles. In order to maximize profitability, it helps firms merge with similar companies. In most cases, the companies are competitors, but the merger allows them to leverage economies of scale, increase pricing power, and reduce employment costs.

Additionally, it increases profits as companies combine their operations, which allows them to focus on improving their products and services. It is also a great strategy for companies looking to increase their size and reduce costs. But what makes it so successful? Read next section.

How Horizontal Integration Works

Horizontal integration is a method of industry consolidation that involves merging two or more companies. This technique can be a beneficial way to increase company size, reduce competition, and access new markets.

In some cases, it may result in industry consolidation, as companies acquire one another through mergers, acquisitions, or hostile takeovers. Often, it occurs when one organization buys another to take over that firm’s assets or operations. This type of merger usually occurs when an organization is competing in a growing industry with limited resources or capabilities.

It can result from industry-wide pressure on costs. Competition between firms may lead to a desire to reduce costs and improve productivity, which can be achieved through economies of scale.

When two companies merge, they may also use their greater purchasing power over suppliers to reduce costs. The same principle applies to other examples. However, there are a variety of legal constraints that can impede this process.

Companies that are not able to achieve the synergies expected from the integration may end up losing value in the long term. For example, companies may merge without realizing the anticipated benefits of the new business model.

When a company merges two companies and sells one of them to a competitor, it may not generate the desired synergies. It is in these circumstances that it may prove to be a failure.

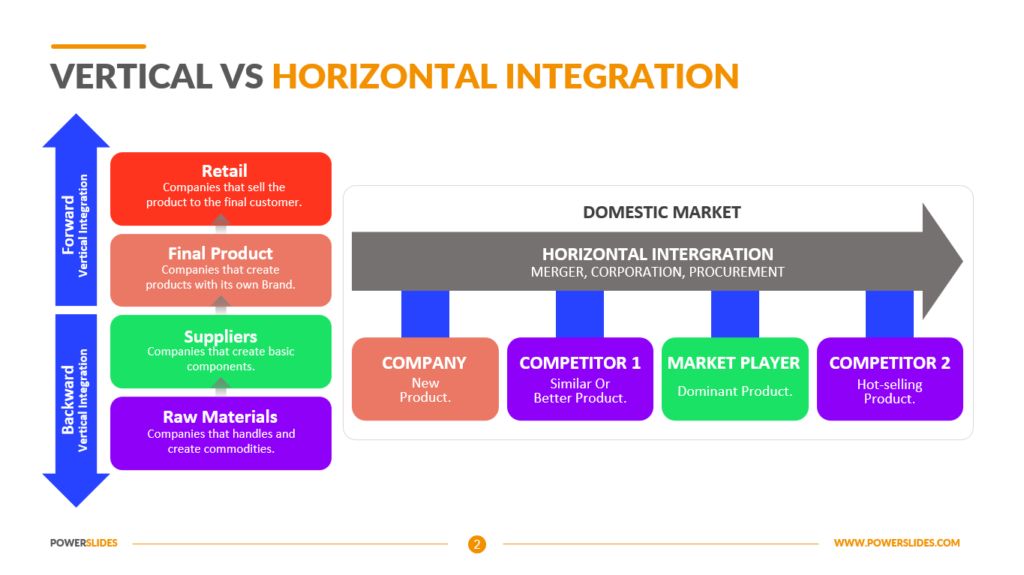

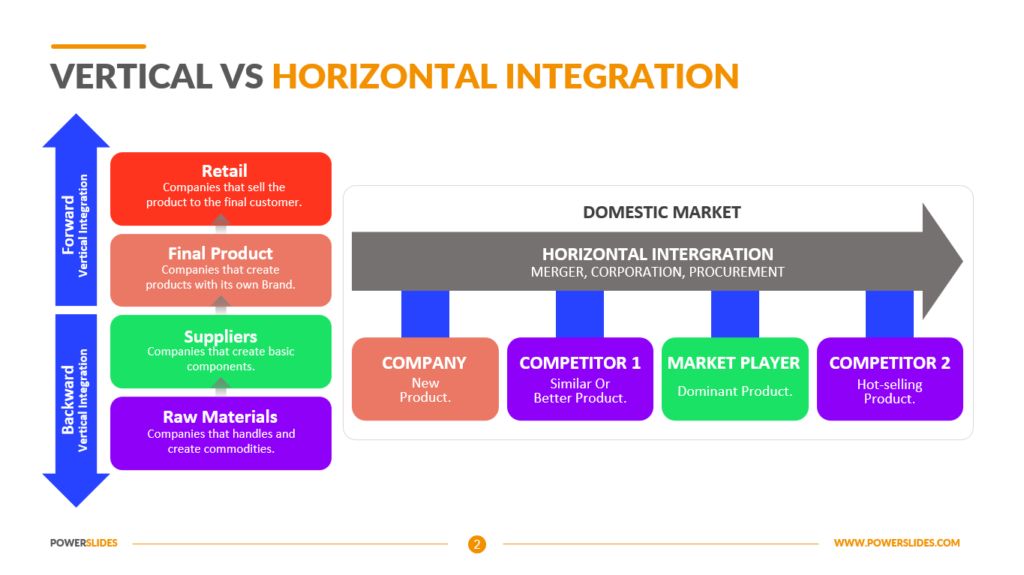

Horizontal vs Vertical Integration

Both methods of integration have their advantages and disadvantages. Vertical is best suited for companies that want to gain exponential growth, while horizontal is suitable for companies that lack the resources to develop new products.

A good example of vertical integration is the acquisition of a company that produces raw materials. This practice can help companies eliminate costs and activate supply chain operations. A bread manufacturing company can buy a trucking company, and this new company can then produce the bread.

In either case, companies will aim to gain more market control than their competitors. A company can eliminate strong competition by improving quality, lowering prices, and offering the best promotions.

Another way is to acquire another company and merge with it. These two strategies often create a larger company, and the aim is to increase profits. Horizontal is more effective in the long run. The combined company should be able to produce products more efficiently.

Types of Horizontal Integration

There are several types of the process, such as mergers and acquisitions and internal expansion. All of these are strategies for maximizing company size, reducing costs, and accessing new markets. However, it can also be the cause of industry consolidation. This type of strategic alliance can take place through mergers, acquisitions, or hostile takeovers. Hostile takeovers are the opposite of vertical integration, and they involve the acquisition of a competitor.

Benefits of Horizontal Integration

Companies that successfully implement this strategy often see significant increases in market share and product offerings. By combining two companies with similar stages, products, and services, it creates a more consolidated entity with better economies of scale, efficiency, and differentiation.

Furthermore, it can help companies gain access to new markets and consumers more quickly. The benefits are not without risks. Some government agencies object the process, as they believe it reduces competition, restricts the ability of smaller firms to compete, and limits their ability to create a competitive advantage.

The main benefit is a reduction of operating costs. As the production volume increases, the cost per unit of output decreases. In addition, economies of scale can help increase the profitability of a firm by reducing the size of its cost structure.

This is because it reduces operating costs while increasing product differentiation. The process also creates a wider customer base. Although the benefits are not immediately evident, it does increase profitability. One of the biggest benefits is the ability to expand business activities while leveraging synergies in marketing and product development. Further, it allows companies to expand their product lines and reach a larger audience.

As a result, the firms that have successfully integrated improve their market shares. This is because both companies bring different customer bases and can maximize revenues by combining them. Furthermore, it increases market share and lowers costs.

Another advantage is the reduction of costs per unit. This can result in a higher profit and stability for the combined company. However, it has the downsides as well. It can create a monopoly, limiting competition and diminishing the consumer’s choice. Horizontal integration can also create a company that is too big to manage, limiting its ability to innovate. This is why the FTC closely monitors it.

An Example

The process involves the merging of two or more businesses to create a single firm with a broader range of products. This process can be the result of an industry-wide pressure on costs.

Competing firms are likely to try to reduce costs by achieving economies of scale, and increasing purchasing power over suppliers. The combined company can command higher prices for its products and enjoy greater influence in the market.

Companies that implement horizontal integration can also reduce costs by sharing processes.

A recent example is the merger of Facebook and Instagram. The company acquired the mobile social network Instagram in 2012 for $1 billion. Both companies share production stages and have similar business models.

Facebook wanted to bolster its social sharing position, and Instagram was the best way to achieve this. Moreover, it bolstered its market position with the acquisition of a smaller, independent company. Note that these two companies have very different cultures and business models.

Final Verdict

Horizontal integration involves the merging of companies in the same industry. Companies do this by merger or acquisition. The two companies should have similar cultures and values, as otherwise, intergration will be unsuccessful. In contrast, vertical integration involves the merging of two companies at different stages of production and distribution.

These mergers and acquisitions help both companies enhance their positioning in the market and reduce their costs. Combined with internal expansion, this can make it possible for a company to increase its market share and reduce its costs.

Leave a Reply

View Comments