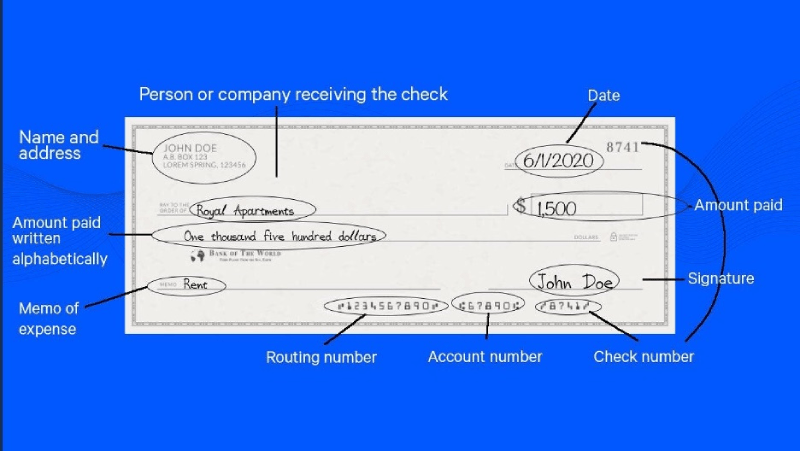

There are a few simple steps you need to follow in order to write a check. First, you’ll need to find a pen and some paper. Then, you’ll want to print or write out the date in the top right-hand corner. After that, you’ll need to write out the recipient’s name in the “Pay to the Order Of” line. Below that, you’ll need to fill in the amount of money, both in numerical and word form. Finally, you’ll need to sign the check in the bottom right-hand corner.

Whether you operate in business management, finance, banking or other spheres, knowing how to write a check is a valuable skill. And not just writing, but the all the other follow up procedures as well.

How to Write A Check: A Step-by-Step Guide

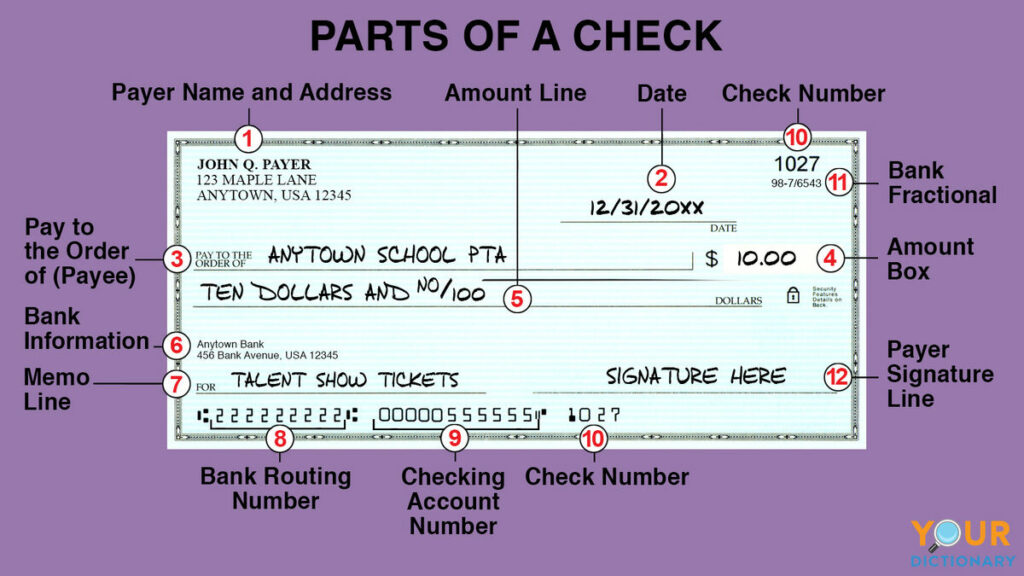

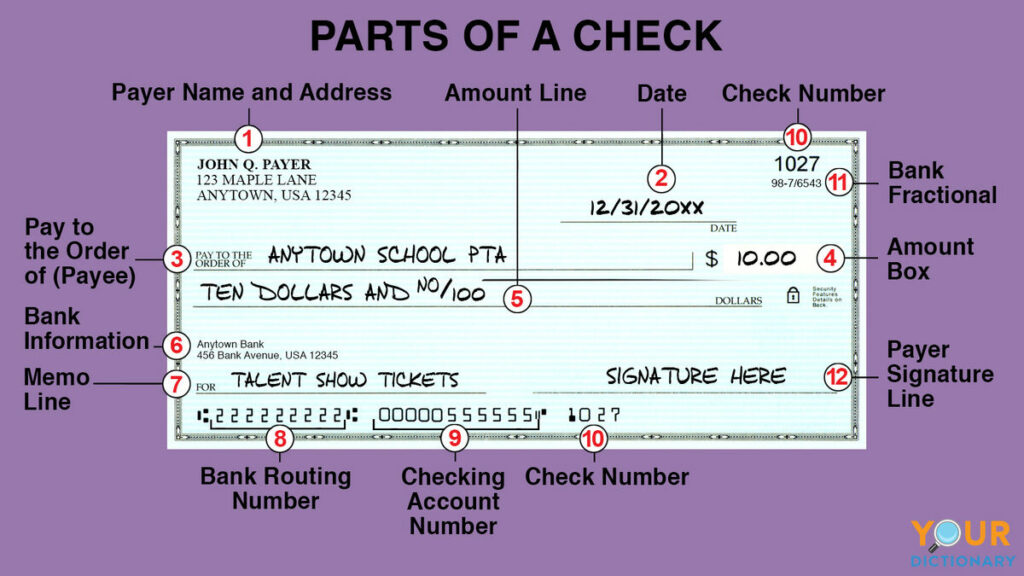

You will need to provide the following information:

- The date of the check

- The name of the payee

- The amount of the check (in numeric form)

- The amount of check in (word form)

- A memo (optional)

- Your signature

Once you have gathered all of this information, you can fill out the check as follows:

The date of the check

This should be written in mm/dd/yyyy format.

The Name of the Payee

Writing the name of the payee is simple. All you need to do is write the name of the person or organization in the “Pay to the Order Of” line.

There are a few things to keep in mind. First, make sure you use the proper grammar and punctuation. Second, be sure to write the name of the payee correctly. Finally, don’t forget to sign the check! These simple tips will help ensure that your check is processed smoothly and without any problems.

The Amount of the check (in Numeric form)

You need to include the amount of money you are authorizing the recipient to withdraw from your account. This amount should be written in both numerical and word form. Fill in the numeric amount of the check in the box provided. Do not write out the dollar sign or any other punctuation, as highlighted below;

The amount of the check (in words)

Write out the same amount on the line below, spelled out in words. For example, if the check is for $150.45, you would spell “One hundred fifty & 45/100.” And if you have a round number like $200, even then you must write additional 00/100 for more clarification. Thus, you’ll write as “Two hundreds & 00/100.” To avoid confusion or errors, it’s always best to write out the full amount. This way, there’s no room for interpretation and both parties will be clear on the exact amount of money involved.

A memo (optional)

If you would like to include a memo, you can do so on the line below the recipient’s name. This is optional but can be useful for your own records or if you are sending the check to someone who may not know why they are receiving it.

Your signature

Sign your name on the bottom right-hand side of the check. This completes the check and makes it legal tender. If you need to sign a check, there are a few things you’ll need to do. First, find a pen that has black or blue ink. Second, locate the line on the check that says “Signature.” Third, write your name on that line. Fourth, date the check. And finally, don’t forget to include the amount of the check in numbers and words on the appropriate lines.

Assuming you have the necessary funds in your account, the process is simple and only takes a few minutes. By following these steps, you can be sure that your check will be correctly filled out and ready to use.

Three Numbers on Check you Must Know

- Routing number

- Account number

- Check number

The three numbers you must know when dealing with your bank are your routing number, account number, and check number.

- Your routing number is the nine-digit code that identifies your bank. It’s usually located at the bottom of your check or on your bank statement.

- Your account number is the unique identifier for your specific account.

- And finally, your check number is the sequence of numbers used to identify a particular check within your account.

All three of these numbers are important when it comes to managing your finances and ensuring that your transactions are processed correctly. Keep them safe and accessible so that you can always keep track of your money.

Tips for Writing a Check

Be sure that the recipient will be able to cash it. Here are some tips to help you:

- Make sure the date is correct. The date should be written in the mm/dd/yyyy format.

- Write the name of the payee correctly. Be sure to use proper capitalization.

- In the “Amount” section, first write the amount in numbers and then draw a line to the right so that no one can change the amount. Then, spell out the amount in words underneath. For example, if the check is for $100, spell “100” and then draw a line next to it followed by “One hundred and 00/100.”

- Sign the check in the signature line. Be sure to use your legal name as it appears on the check.

- Include any additional information that may be required, such as your account number or routing number.

Be Safe

Most people don’t think twice. After all, check is just a piece of paper with some numbers on it, right? Wrong. It is actually a very serious matter. Because you are essentially giving someone else permission to take money out of your bank account. And if you don’t have enough money in your account to cover the check, you could be on the hook for some hefty fees.

So what can you do to avoid problems? Here are a few tips:

- Make sure you have enough money in your account. This may seem like a no-brainer, but it’s amazing how many people do this without bothering to check their balance first. Avoid this mistake by always checking your balance first.

- Use a pencil. Yes, a pencil. Why? Because if you make a mistake in your check, you can simply erase it and start over. If you use a pen, you’ll either have to start over with a new check or try to cross out the mistake, which can be confusing for the person who ultimately receives the check.

- Write legibly. This may seem like another no-brainer, but you’d be surprised how often checks are barely readable. Not only is this annoying for the person who has to decode your writing, it can also lead to errors (see tip number four).

- Use numbers. When you write out the amount, use numbers as well as words. That way, if there’s a discrepancy between what you wrote and what the recipient reads, they can quickly and easily refer to the numbers to figure out what the correct amount should be.

- Sign carefully. This is perhaps the most important tip of all. When you sign a check, you are authorizing the bank to pay the amount of the check out of your account. So be careful not to sign a blank check (which would give someone free rein to any amount of money) and be sure that the amount in both words and numbers matches the amount you’re signing for.

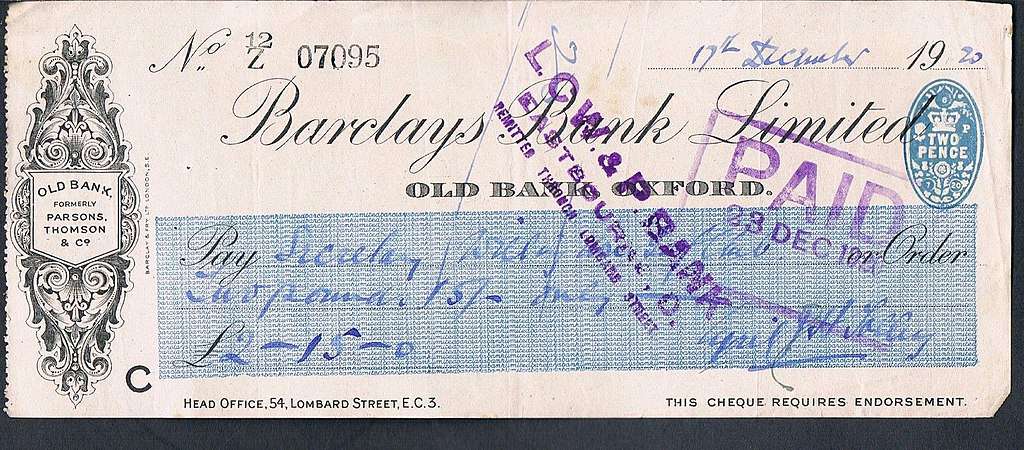

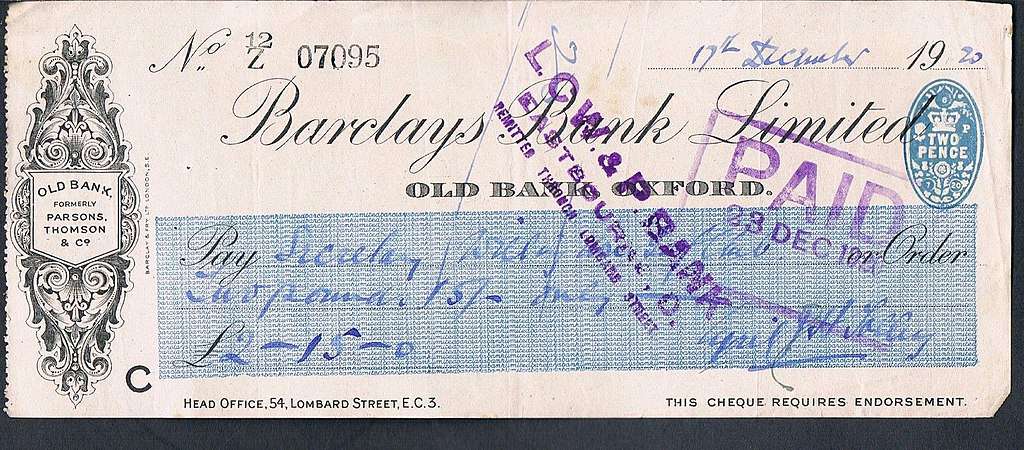

How to Endorse a Check

There are a few different ways that you can endorse a check.

- The most common way is to simply sign the back of the check. You can also use a stamp or spell “For Deposit Only” on the back of the check. If you are endorsing a check for someone else, you will need to include their name as well as your own.

- Another way to endorse a check is to include your account number. This is often done when you are depositing the check into your bank account. By including your account number, you are authorizing the bank to deposit the funds into your account.

- When you endorse a check, you are essentially giving the recipient permission to use the funds. For example, if you endorse a check for deposit only, the bank will not be able to cash the check for you. However, if you endorse a check with your signature, the recipient can cash the check at any bank.

Endorsing a check is a simple process, but it is important to make sure that you do it correctly. If you are unsure of how to properly endorse a check, you should consult your bank or the payee for guidance.

Blank Endorsement

A blank endorsement is a type of check endorsement that doesn’t specify who can cash or deposit the check. Blank endorsements are sometimes used when someone needs to cash a check but doesn’t have time to go to their bank.

If you endorse a check with a blank endorsement, anyone who has the check can deposit it or cash it. That means that you’re taking responsibility for the check and whoever uses it. So, if the check is lost or stolen, you could be responsible for any funds that are taken out of the account.

Blank endorsements aren’t always accepted by banks, so it’s important to know their policy before endorsing a check this way. And, as always, be sure to keep your endorsed checks in a safe place until you can get them to the bank.

Third-Party Endorsement

A third-party endorsement is when a person or organization not directly involved with a product or service recommends it. This can be in the form of a written testimonial, social media post, or even just word-of-mouth.

Third-party endorsements are powerful because they come from an unbiased source that consumers trust. When someone we respect tells us that they like a product, we’re more likely to believe them than if the company itself is making the claim.

There are a few things to keep in mind when using third-party endorsements:

- Make sure the endorser is credible and their endorsement is genuine. If it doesn’t seem authentic, it will backfire.

- Be aware of the potential for conflict of interest. For example, if a celebrity is being paid to endorse a product, that should be disclosed.

- Use endorsements sparingly and in context. Too many glowing testimonials can seem fake, and out-of-context endorsements can appear random or misleading.

When used correctly, third-party endorsements can be a powerful way to build trust and credibility with your audience.

Mobile Deposit Endorsement

Mobile deposit is a great way to deposit checks without having to visit a bank or credit union branch. With the rising relevance of mobile first indexing and mobile-friendly user interfaces, this is important to get right. However, there are a few things you need to know before you can start using this service.

- For starters, you’ll need to endorse the check. This simply means that you’ll need to sign the back of the check. You’ll also need to write “For Mobile Deposit Only” beneath your signature. This lets the recipient know that you’re authorizing them to deposit the check electronically.

- Once you’ve endorsed the check, you can then take a photo of it using your mobile device’s camera. Make sure that the entire check is visible and in focus before taking the picture. Once you’ve taken a satisfactory photo, you can then submit it for deposit via your bank or credit union’s mobile app.

- In most cases, the funds from a mobile deposit will be available within one business day. However, it’s always a good idea to check with your bank or credit union to verify their specific policies and procedures.

Mobile deposit is a convenient way to deposit checks without having to visit a branch. Just remember to endorse the check and take a clear photo of it before submitting it for deposit.

Business Endorsement

Business endorsements are a great way to promote your company or product. By having a well-known person or organization endorse your business, you can increase your exposure and credibility.

- When choosing who to ask for an endorsement, it is important to select someone who is respected in the industry and has a good reputation. Additionally, they should be familiar with your product or service and be able to speak positively about it.

- Asking for an endorsement can be done in person or by sending a letter or email request. When making the request, be sure to explain what you are looking for and why you think the person would be a good fit. Be polite and professional, as this will help increase the chances of getting a positive response.

- Once you have received an endorsement, be sure to promote it! This can be done by sharing it on social media, placing it on your website, or sending out a press release. By getting the word out, you will maximize the benefits of having a business endorsement.

Multiple Payee Endorsement

A multiple payee endorsement is an endorsement on a check that names more than one payee. This type of endorsement is often used when two or more people are splitting the money from the check. To endorse a check with a multiple payee endorsement, each person who is to receive money from the check must sign their name on the back of the check.

When using a multiple payee endorsement, it’s important to make sure that all of the necessary information is included. This includes the amount of money that each person is to receive, as well as their signature. Without this information, it may be difficult to determine how the money should be divided up. It can be a convenient way to split money from a check, but it’s important to make sure that all of the necessary information is included. Otherwise, you may run into problems later on.

How to Deposit a Check

Assuming you have a checking account with a bank, cashing or depositing a check is easy. Just follow these steps:

- Endorse the check by signing your name on the back. If you’re depositing the check into an ATM, you may not need to sign it.

- Spell “For deposit only” above your signature on the back of the check. This ensures that the teller knows you’re not trying to cash the check.

- Take the check to your bank and insert it into an ATM or hand it to a teller. You may need to show your ID if you’re depositing at an ATM that’s not affiliated with your bank.

- The bank will process the check and the money will be deposited into your account. The funds may not be available immediately, depending on your bank’s policies.

ATM deposit

ATM deposit refers to the process of depositing money into a bank account using an automated teller machine (ATM). Those are convenient because they can be done without having to visit a bank branch. However, there may be fees associated with making an ATM deposit, and the funds may not be immediately available for use. Before making an ATM deposit, it is important to check with your bank to see if there are any restrictions or fees that apply.

When making an ATM deposit, you will generally be asked to insert your bank card into the machine and enter your PIN. After this, you will be prompted to select the account into which you would like to deposit the funds. You will then need to insert the cash or checks that you wish to deposit. The machine will count the money or scan the checks and provide you with a receipt confirming the transaction. The funds should then be available for use within 1-2 business days.

Making regular deposits into your bank account is important in order to maintain a good relationship with your bank and keep your account in good standing. If you have any questions about how to make an ATM deposit, please contact your bank for more information.

Mobile check deposit

If you have a smartphone, you can now deposit checks using a mobile check deposit app. This is a convenient way to deposit checks if you don’t have time to go to the bank. To use mobile check deposit, simply download the app and follow the instructions. You’ll need to take a picture of the front and back of the check and enter some basic information. Once you’ve submitted the check for deposit, it will be processed within one to two business days.

One thing to keep in mind with mobile check deposit is that there may be limits on how much you can deposit at one time. Be sure to check with your bank or credit union before you try to deposit a large check. Also, keep in mind that you may not be able to use mobile check deposit for all types of checks, such as money orders or traveler’s checks. But for most personal and business checks, mobile check deposit is a convenient way to make a deposit without having to go to the bank.

In-person deposit

If you need to make an in-person deposit, you can do so at any of branches. To find the branch closest to you, please use bank Branch Locator tool. When making a deposit in person, please have your account number and photo ID ready.

How to Order Checks

If you need checks, you can order them through your bank or a check printing company. Be sure to have your routing and account numbers handy when ordering.

When ordering checks, you’ll need to decide what kind of design you want. Many banks and check printing companies offer a variety of designs to choose from. You may also be able to add a personal touch by including a photo or other image on your checks.

Once you’ve decided on a design, simply place your order and provide the necessary information. Your checks should arrive within a few weeks. If you need them sooner, many companies offer expedited shipping for an additional fee.

How to Order Checks Online

If you’re tired of waiting in line at the bank or dealing with paper checks, you can now order checks online. This process is simple and easy, and it will save you time and money. Plus, you’ll have access to a wide variety of designs to choose from. Here’s how to do it:

- Go to the website of your bank or credit union.

- Find the section on ordering checks.

- Follow the instructions on how to order checks online.

- Enter your personal information, such as your name, address, and phone number.

- Select the type of check you want to order.

- Choose the quantity of checks you need.

- Enter your payment information.

- Review your order and submit it.

- Your checks will be delivered to you within 7-10 business days.

Now that you know how to order checks online, give it a try the next time you need to reorder checks! You’ll be glad you did.

FAQs

Can I write a check to myself?

Yes. You’ll need to fill out the check with your own name as the payee and sign it. Then, you can cash or deposit the check just like any other check. Keep in mind that some banks may charge fees for cashing or depositing checks to yourself.

Is it necessary to have someone’s bank account?

No, you don’t need to know someone’s bank account. You only need the person’s name and address. However, if you want the check to be processed quickly and without any problems, it’s always best to include the correct routing number and account number. This way, the check can be deposited directly into the person’s account.

Who signs the back of a check?

The person who writes the check is the only one who can sign the back of it. This is to prevent someone else from cashing or depositing the check. The signature on the back of a check serves as a guarantee that the funds will be paid out to whomever presents the check.

Why you should never write checks with a pen?

There are a few reasons for this.

- First, if the check is lost or stolen, it can be cashed by anyone who finds it.

- Second, if the check is altered in any way, it may not be honored by the bank.

- And third, if you need to cancel the check for any reason, it can be difficult to do so if it’s in ink.

So always use a pencil – it’s much safer and more secure.

What Happens If You Make a Check with No Money in Your Account?

With no money in your account, the check will likely bounce. This means that the check will be returned to the person or institution who attempted to cash it, and you may be charged a fee. It’s better to be financially secure and sure that you have money in your account when you make a check. In some cases, you may also be subject to criminal charges. If you’re not sure whether you have enough money in your account to cover a check, it’s always best to check with your bank first.

What is the limit for a personal check?

There is no limit for personal checks, but banks may place their own limits on the amount of money that can be withdrawn from an account using a personal check. Contact your bank to learn more about any potential limits they may have in place.

How long does it take for a bank to process a check?

The answer to this question depends on the bank and the type of check being processed. For example, a personal check may be processed faster than a business check. In general, however, it usually takes a few days for a check to be processed by a bank. Once the check is received by the bank, it will need to be verified for accuracy and validity. This process can take a few days.

After the check is verified, it will be deposited into the account of the person or business who it belongs to. The funds may not be immediately available, however, as banks typically place a hold on deposited checks. The length of this hold may vary depending on the amount of the check and the policies of the particular bank. Once the hold is released, the funds will be available for use. Depending on the bank, this process can take a few days to a week or more.

Is it illegal to write a post-dated check?

There is no federal law that prohibits such action. However, some states have laws that prohibit post-dating. In addition, many banks and credit unions will not accept post-dated checks. So, while there is no legal prohibitions against a post-dated check, it may not be honored by the bank or financial institution.

There are a few states that have laws prohibiting post-dated checks, so it is important to check the laws in your state first. Even if your state does not have a law against post-dating, your bank or credit union may still refuse to accept the check. So it is always best to check with your financial institution beforehands.

The Bottom Line

Assuming you have followed all of the advice in this article, you should now know how to write a check correctly. Remember to always use blue or black ink, print legibly, and use an authorized check format. Always keep a record of your checks in order to reconcile your accounts later on. Finally, don’t forget to sign the back of the check! We hope you found this article helpful. Writing a check doesn’t have to be complicated – just follow the steps we outlined and you’ll be able to do it with ease. Thanks for reading!

Leave a Reply

View Comments