Is real estate and real estate investment trust a good career path? What skills or qualifications does one need to pursue a career in this field? Do you need a degree or a certificate? How do you get a job and which sector should you work in? We’re going to answer all these questions and more. Read on.

The Field Of Real Estate

Real estate includes land, buildings, and resources like water and minerals. It covers residential and commercial properties, offices, retail stores, and vacant land. It is an important part of the economy, involving buying, selling, renting, and development.

There are several key aspects:

- Residential Real Estate: This includes properties designed for people to live in, such as houses, apartments, condominiums, townhouses, and vacation homes.

- Commercial Real Estate: This involves properties used for business purposes, such as office buildings, retail stores, shopping centers, hotels, and warehouses.

- Industrial Real Estate: It comprises properties used for industrial operations, such as factories, manufacturing plants, distribution centers, and logistics facilities.

- Land: Vacant land or undeveloped property that can be used for various purposes, such as agriculture, development, or conservation.

Real estate is bought, sold, or leased through agents who facilitate transactions. Factors like location, demand, and property condition influence its value.

Investing in real estate generates income and builds wealth. Investors rent or develop properties to increase their value. Real estate can also be bought and sold for speculative purposes.

The laws and regulations related to real estate can vary from one country to another, so you need to consider the specific legal and market conditions in a particular region when dealing with transactions.

What Is Real Estate Investment Trust?

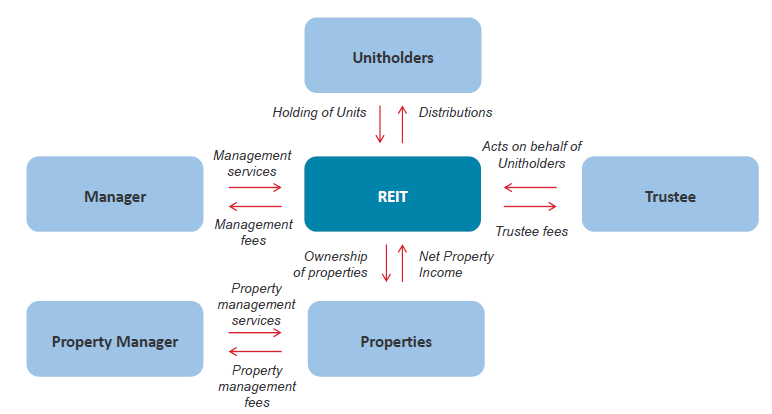

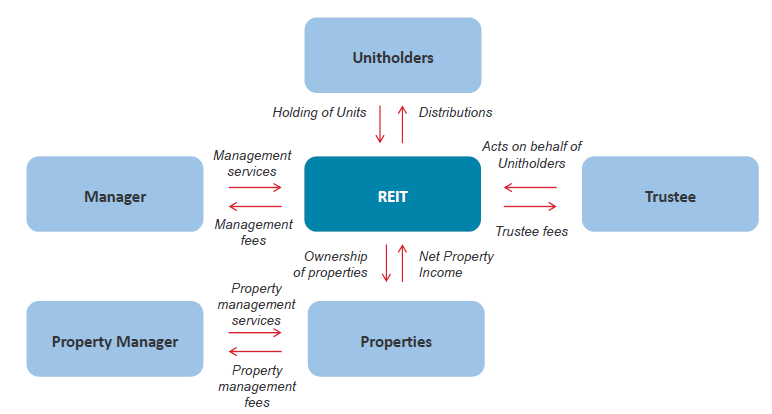

A real estate trust, also called a REIT, is a company that owns, operates, or finances income-generating real estate. It allows individuals to invest in real estate assets, similar to mutual funds.

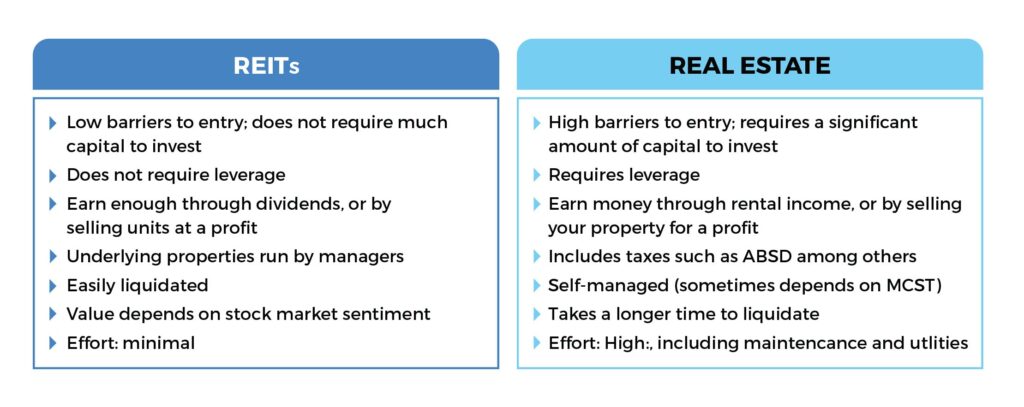

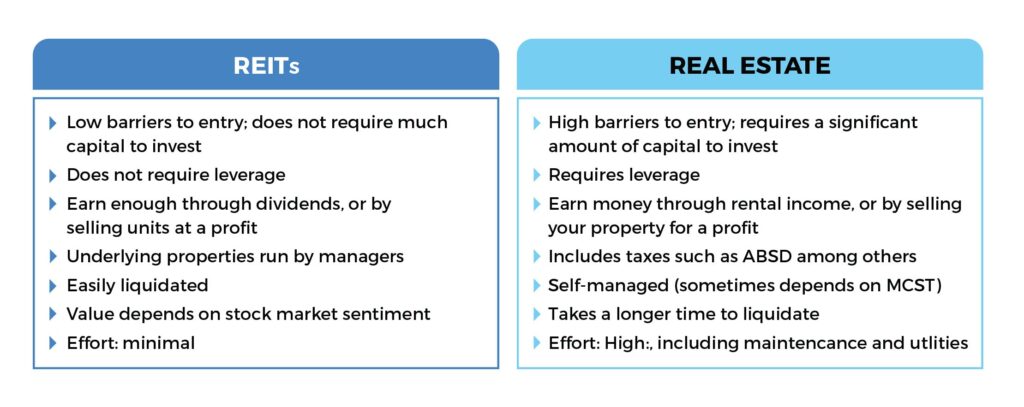

REITs offer several advantages to investors:

- Income Generation: Typically generate income through rental payments from tenants of their properties. By law, REITs are required to distribute a significant portion of their taxable income (usually 90% or more) to shareholders in the form of dividends. This feature allows investors to benefit from regular income streams.

- Diversification: Investing in REITs provides diversification benefits, as these trusts typically own and manage a portfolio of different types of real estate assets. This diversification helps mitigate risks associated with investing in a single property or real estate sector.

- Accessibility: Are publicly traded on stock exchanges, making them easily accessible to individual investors. They can be bought and sold like stocks, providing liquidity and flexibility compared to direct real estate investments.

- Professional Management: REITs are managed by professionals who have expertise in acquiring, developing, and managing real estate assets. Investors can benefit from the experience and knowledge of these professionals without having to directly manage the properties themselves.

REITs must meet regulations for tax benefits. Requirements include distributing income to shareholders and investing in real estate. Meeting these conditions allows them to avoid corporate taxes and pass taxable income to investors.

Note:

Investing in REITs has risks like other investments, including property value fluctuations, interest rate changes, and market conditions. Consider investment objectives, risk tolerance, and do research before investing. It’s advised to consult a financial advisor to evaluate personal circumstances and goals.

How Many Jobs Are Available In Real Estate Investment Trusts?

There are various career opportunities available in the real estate and REITs industry. Some common roles and professions include:

Real Estate

- Real Estate Agent/Broker: Real estate agents or brokers help individuals and businesses buy, sell, or rent properties. They facilitate transactions, market properties, negotiate deals, and provide guidance to clients.

- Property Manager: Property managers oversee the day-to-day operations of real estate properties on behalf of owners. They handle tasks such as tenant relations, lease management, property maintenance, and financial management.

- Real Estate Developer: Developers identify and acquire properties for development or redevelopment. They coordinate various aspects of the development process, including land acquisition, zoning and permits, construction, and marketing.

- Real Estate Analyst: Analysts conduct research and analysis on real estate markets, properties, and investment opportunities. They evaluate financial data, market trends, and property performance to provide insights and recommendations for investment decisions.

REITs:

- REIT Portfolio Manager: Portfolio managers oversee the investment activities of a REIT. They develop investment strategies, analyze properties for acquisition or disposal, manage property portfolios, and monitor performance.

- REIT Financial Analyst: Financial analysts specializing in REITs analyze financial data, assess investment opportunities, and evaluate the performance of REITs. They help with financial modeling, forecasting, and reporting.

Non Specific General Industry Jobs

- Real Estate Appraiser: Appraisers determine the value of properties for various purposes, such as sales, mortgages, and investment analysis. They assess factors such as location, condition, and market conditions to provide an estimated value.

- Real Estate Lawyer: Real estate attorneys specialize in legal matters related to property transactions, leases, zoning regulations, and contract negotiations. They provide legal advice, draft and review documents, and handle legal disputes.

- Real Estate Marketing and Sales: Marketing and sales professionals in the real estate industry develop marketing strategies, advertise properties, generate leads, and facilitate property sales.

- Real Estate Researcher: Researchers conduct market research, gather data, and provide analysis to support investment decisions, urban planning, market forecasting, and other real estate-related initiatives.

The industry offers a wide range of opportunities across various sectors, including residential, commercial, industrial, and retail real estate. Roles can vary from entry-level positions to senior management and executive roles, depending on experience, expertise, and qualifications.

Working For Real Estate or For REITS

To pursue a career in real estate, start by gaining a solid understanding of the real estate industry. Learn about different sectors, market trends, regulations, and career options. This will help you make informed decisions and identify the areas that interest you the most.

Depending on your career goals and country/region, consider completing relevant educational programs or courses in real estate. Many jurisdictions require licensing for real estate agents and brokers. Research the requirements in your area and fulfill any necessary education and licensing prerequisites.

Some things you need to consider:

- Experience: Seek opportunities to gain practical experience in the real estate field. This could involve internships, entry-level positions, or shadowing experienced professionals. Look for real estate agencies, property management firms, or developers who offer mentorship or training programs.

- Network: Networking is crucial in the real estate industry. Attend industry events, join professional associations, and engage with real estate professionals. Build relationships with real estate agents, brokers, developers, and other industry experts who can provide guidance, advice, and potential job opportunities.

- Specialization: Determine your area of interest within the real estate industry. It could be residential, commercial, industrial, or a specific niche like luxury properties or sustainable real estate. Specializing can help you develop expertise and stand out in a particular field.

- Skills: Real estate careers require a range of skills, including negotiation, communication, sales, marketing, financial analysis, and customer service. Continuously work on improving these skills through training, workshops, and on-the-job experiences.

- Consider Further Education: Depending on your career aspirations, you may consider pursuing advanced degrees or certifications in real estate, finance, or related fields. These credentials can enhance your knowledge, credibility, and career prospects.

- Build a Professional Brand: Create a professional brand for yourself in the real estate industry. Establish an online presence through a professional website or social media profiles. Showcase your expertise, share valuable content, and highlight your achievements to attract potential clients or employers.

What to do after you get the job or find the perfect job opening?

Stay up to date with market trends, industry news, and changes in regulations. Subscribe to relevant publications, join industry forums, and participate in professional development activities to stay informed and maintain a competitive edge.

Keep looking for job openings, internships, or entry-level positions in real estate agencies, property management firms, developers, or other related companies. Leverage your network, online job portals, and industry-specific websites to find opportunities that align with your career goals.

Real estate careers require dedication, hard work, and perseverance. It can take time to build a successful career, but with continuous learning, networking, and a strong work ethic, you can thrive in the real estate industry.

Working In REIT Management

REIT (Real Estate Investment Trust) management can be a rewarding career path within the real estate industry. REITs are investment vehicles that own and operate income-generating real estate properties. Some key aspects of REIT management as a career include:

Portfolio Management:

REIT managers oversee the investment portfolio, analyze market trends, make strategic decisions, and monitor property performance.

Property Acquisition and Disposition:

They assess properties for acquisition, considering their financial viability, market potential, and alignment with the investment strategy. They negotiate purchase agreements, conduct property inspections, and oversee transactions. They also handle property sales that align with the investment objectives.

Financial Analysis:

REIT managers perform financial analysis and modeling to evaluate investment opportunities, assess property performance, and forecast returns. They analyze cash flows, occupancy rates, lease terms, and other financial metrics to make informed investment decisions.

Investor Relations:

They maintain relationships with REIT investors, providing updates, answering inquiries, and addressing concerns to build trust and maintain confidence.

Compliance and Regulation:

REIT managers ensure compliance with regulatory requirements specific to REITs, such as distributing a significant portion of income to shareholders and adhering to tax regulations. They stay updated on changes in laws and regulations that affect REIT operations and make necessary adjustments to maintain compliance.

Market Research and Analysis:

They have to conduct market research to identify trends, opportunities, and potential risks in the real estate market. They monitor economic indicators, supply and demand dynamics, and demographic trends to inform investment strategies and identify potential market niches.

Risk Management:

They managers assess and manage risks associated with the real estate portfolio. They implement risk mitigation strategies, such as diversification, insurance coverage, and contingency planning, to protect the REIT’s assets and investors’ interests.

Team Leadership:

REIT managers lead teams of professionals, including analysts, asset managers, leasing agents, and administrative staff. They provide guidance, set performance goals, and ensure effective collaboration to achieve the REIT’s objectives.

To work in REIT management, a background in real estate, finance, or a related field is important. Degrees in finance, real estate, or business administration can help. Professional certifications like the CRMP can also boost your credibility.

Networking, attending events, and staying updated on market trends and regulations are crucial for success in REIT management. This field combines real estate and finance, with roles in investment analysis, portfolio management, and investor relations.

The Best Real Estate Entry Level Jobs For A Newbie

The best job in real estate for a beginner can depend on your skills, interests, and long-term goals. Here are a few entry-level roles that can provide a solid foundation for a career in real estate. Many of them are that of an assistant.

Real Estate Assistant:

Being a real estate assistant provides hands-on experience in the industry. You support agents, brokers, and managers with admin tasks, marketing, communication, and property showings. It helps you learn the process and build professional relationships.

Leasing Consultant:

As a leasing consultant, you assist with renting properties for owners or companies. You handle inquiries, give tours, process applications, and negotiate leases. This role helps you develop customer service skills and gain rental market knowledge.

Property Management Assistant:

As a property management assistant, you gain experience in real estate operations by helping property managers with rent collection, tenant communication, maintenance coordination, and property inspections. This role lets you learn about property management and interact with tenants, vendors, and service providers.

Real Estate Salesperson:

To work in real estate, get licensed to assist buyers and sellers in property deals. With a license, you can earn more, gain sales experience, and build a client base.

Real Estate Researcher/Analyst:

Entry-level real estate research or analysis jobs offer a strong base for market research, financial analysis, and data interpretation. Duties include gathering and analyzing market data, tracking industry trends, assisting with property valuations, and aiding investment decision-making.

Many entry-level real estate roles are available. Consider your skills, interests, and career goals when choosing a job. Networking, learning, and seeking mentorship can enhance your advancement in the industry.

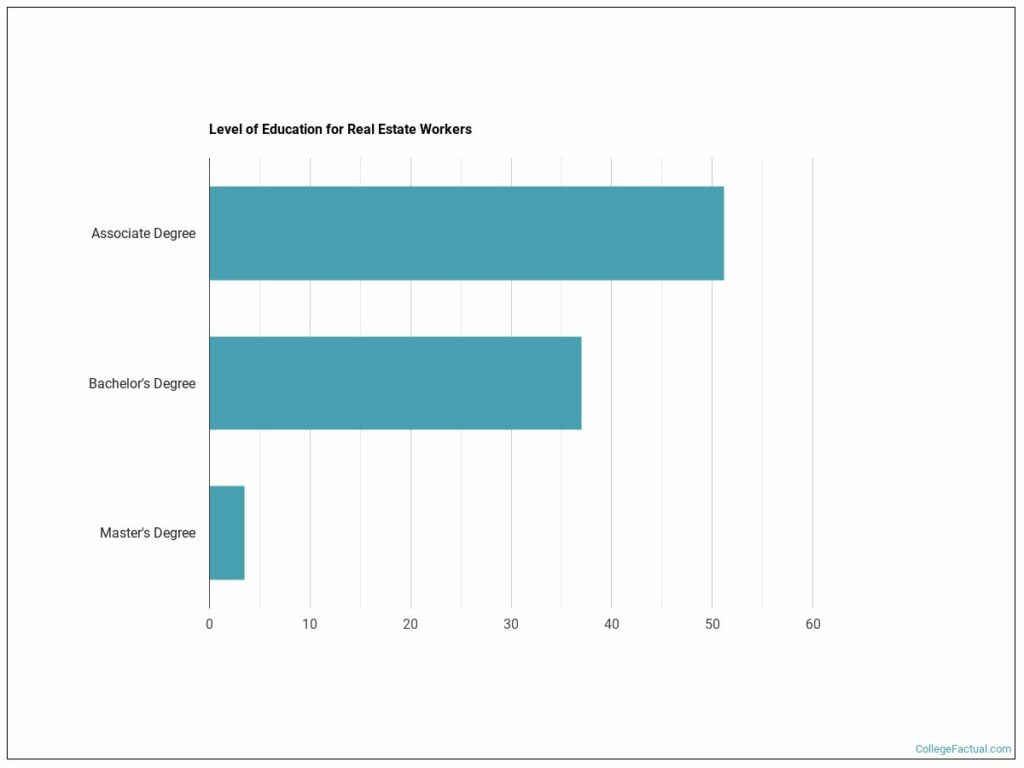

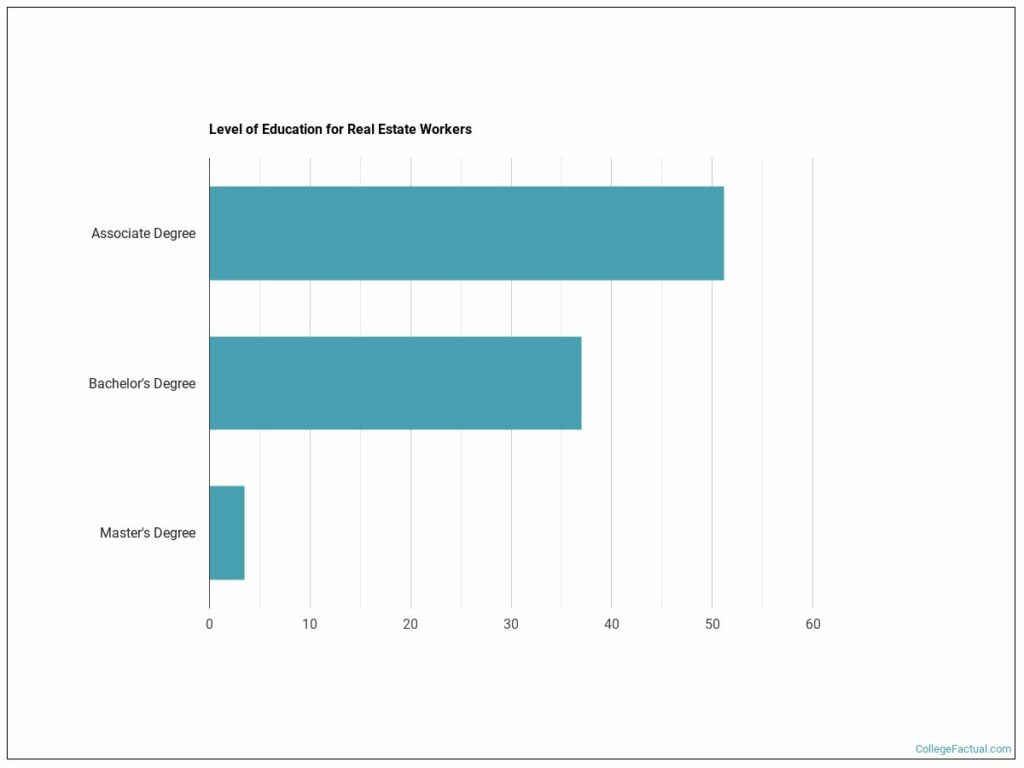

Requirements To Work In REITS: Is The Degree Necessary?

In some countries, a degree is not necessary to work in real estate. However, certain roles may require specific education. A degree can be helpful for gaining knowledge, skills, and credibility. Consider these points about degrees.

- Real Estate Agent/Broker: In many regions, becoming a real estate agent or broker typically requires completing pre-licensing courses and passing a licensing exam. While a degree is not always a requirement, some states or countries may have educational prerequisites or credit hour requirements. It’s important to research the licensing requirements in your area.

- Property Manager: Property management roles often do not strictly require a degree. However, having a degree in fields such as business, real estate, finance, or property management can provide a foundation of knowledge and skills that are valuable in this profession.

- Real Estate Developer: A degree in fields such as real estate, urban planning, architecture, construction management, or finance can be beneficial for individuals aspiring to become real estate developers. Such degrees provide a deeper understanding of the industry, development processes, and financial aspects.

- Real Estate Analyst: Real estate analysis roles can benefit from a degree in finance, economics, or real estate. These degrees provide the analytical skills and knowledge necessary to evaluate investment opportunities, conduct market research, and perform financial modeling.

Although a degree is not always necessary, the real estate industry values practical experience, networking, and specialized knowledge. Pursuing certifications, attending training programs, and gaining hands-on experience can help build a successful career. Research expectations in your area, evaluate your goals, and consider how education can support your real estate career.

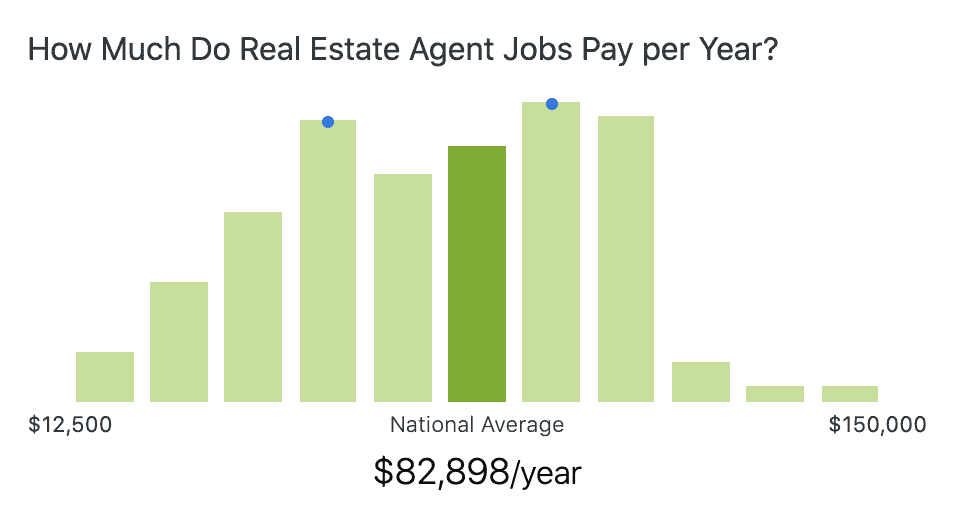

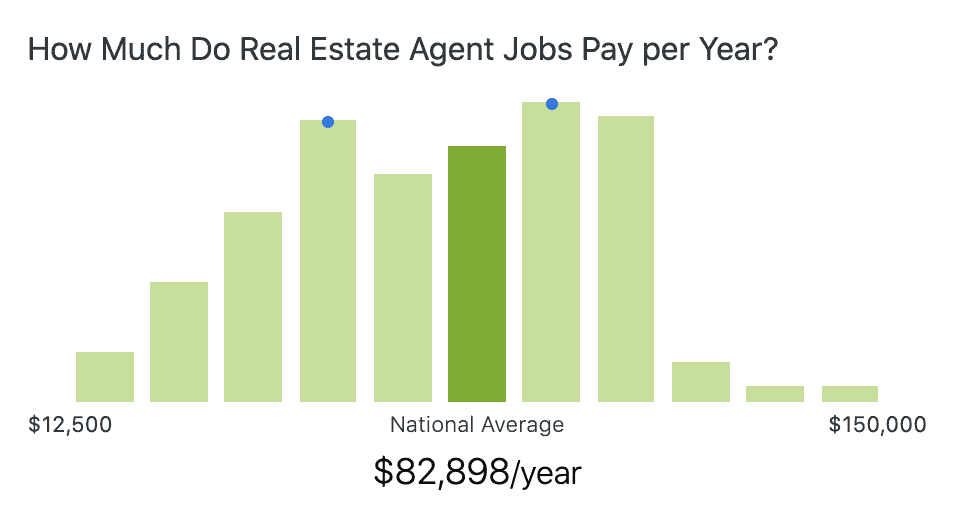

How Much Does A Career In Real Estate Pay?

The salary range in real estate jobs can vary significantly depending on factors such as the specific role, level of experience, location, company size, and the state of the real estate market. Some approximate salary ranges for common real estate positions to give you the general idea:

Real Estate Agent/Broker:

Real estate agents earn commissions based on their sales or leases. The income varies and depends on completed transactions. According to the U.S. Bureau of Labor Statistics, the median annual wage for agents in 2023 is about $86,300, but it can vary.

Property Manager:

Property managers typically receive a salary rather than commissions. The salary range can vary depending on factors such as the size and complexity of the properties managed and the geographic location. In the United States, property managers can earn an average salary of around $60,000 to $80,000 per year, but this can vary significantly.

Real Estate Developer:

Real estate developers generate income through different means, including fees, profit sharing, and ownership of development projects. Their earnings can greatly differ based on the size and accomplishment of these projects. When projects are finished and either sold or leased, developers can receive salaries or substantial profits. The income range for real estate developers is extensive, spanning from tens of thousands to millions of dollars annually, contingent on the projects and degree of achievement.

Real Estate Analyst:

Real estate analysts typically earn salaries that vary based on factors such as experience, location, and the size and complexity of the firm they work for. Entry-level real estate analysts may earn around $50,000 to $70,000 per year, while more experienced professionals or those in senior positions can earn significantly more, ranging from $80,000 to $150,000 or more annually.

Real Estate Appraiser:

Real estate appraisers typically earn fees for their appraisal services rather than a fixed salary. The income can vary depending on factors such as the complexity of the appraisal, property type, geographic location, and the demand for their services. According to the U.S. Bureau of Labor Statistics, the median annual wage for real estate appraisers and assessors is around $88,000 in 2023.

Note that salary ranges can vary based on factors mentioned earlier. Real estate is commission-based, and earnings can fluctuate based on performance and market conditions. Research industry-specific salary data, consult job market reports, and consider local factors for accurate understanding of salary ranges in your location and field.

REITS Careers: Working For A Multi-Sector Company

Working in real estate will most of the time lead to working for a multi sector company. Such a job can offer both advantages and challenges, and whether it’s a good career path for you depends on your individual preferences, skills, and career goals.

Advantages of Multi-Sector Companies:

- Diversified Experience: Multi-sector companies operate in different industries, which can provide you with exposure to a variety of sectors. This can broaden your skill set, expand your knowledge base, and make you adaptable to different environments.

- Career Mobility: Working for a multi-sector company can offer opportunities for career mobility within the organization. As the company operates in multiple sectors, you may have the chance to explore different roles and industries, allowing for career growth and development.

- Network Expansion: Multi-sector companies often have extensive networks across various industries. This can provide you with valuable networking opportunities and connections that may benefit your career in the long term.

- Stability and Resilience: Diversification across sectors can help multi-sector companies withstand economic fluctuations. In uncertain times, having exposure to multiple sectors can provide stability and job security.

Challenges of Multi-Sector Companies:

- Specialization vs. Generalization: Working in a multi-sector company may require a broader skill set rather than specialized expertise. If you prefer to focus deeply on a specific industry or function, a specialized company or industry-specific role may be better.

- Industry Knowledge: Operating in multiple sectors means you need to stay updated on trends, regulations, and dynamics across various industries. This requires continuous learning and adaptability to be effective in different sectors.

- Fragmented Focus: Multi-sector companies may face challenges in prioritizing resources and attention across diverse business lines. This can result in less focus on specific sectors or slower decision-making processes.

- Industry-Specific Opportunities: Depending on your career goals, certain industries may offer more specialized career advancement opportunities or higher salaries compared to multi-sector companies. If you have a specific passion or interest in a particular sector, a focused career path may be more fulfilling.

Think about if you prefer a wide range of experiences or a deep focus. Also, think about if you can adapt to different industries and if you are willing to keep learning in different sectors. Research the company, its culture, growth opportunities, and how it fits with your career goals. Seek advice from professionals who have worked in multi-sector companies to learn more.

Leave a Reply

View Comments